Basic Concepts

New to IFRS 17? Need to catch up quickly ahead of quarterly reporting? Already know something about the standard but need a refresher on the basics before diving deeper? This is the course for you!

Overview of IFRS 17

IFRS 17 was effective January 1, 2023, with Parallel Reporting required for the period January 1, 2022 to December 31, 2022.

IFRS 17 replaces the existing IFRS 4 accounting standard. It has been a major implementation task for all insurers in Canada.

IFRS 17 “establishes principles for the recognition, measurement, presentation and disclosure of insurance contratcs within the scope of the Standard.”

IFRS 17 Applies to:

- Insurance contracts, including reinsurance contracts an entity issues

- Reinsurance contracts an entity holds; and

- Investment contracts with discretionary participating features the entity issues, provided the entity also issues insurance contracts

IFRS 17 Does not Apply to:

- Warranties provided by a manufacturer, dealer or retailer in connection with the sale of its goods and services to a customer

- Employers’ assets and liabilities from employee benefit plans and retirement benefit obligations reported by defined benefit retirement plans

- Contractual rights or contractual obligations contingent on the future use of, or the right to use, a non-financial item (licence fees, royalties, etc.)

- Residual value guarantees provided by a manufacturer, dealer or retailer and a lessee’s residual value guarantees when they are embedded in a lease

- Financial guarantee contracts, unless the issuer has previously asserted explicitly that it regards such contracts as insurance contracts and has used accounting applicable to insurance contracts.

- Contingent consideration payable or receivable in a business combination

- Insurance contracts in which the entity is the policyholder (“self-insurance”), unless those contracts are reinsurance contracts held

Insurance Contract

IFRS 17 Appendix A Definition:

“A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.”

Insurance Risk

IFRS 17 Appendix A Definition:

“Risk, other than financial risk, transferred from the holder of a contract to the issuer.”

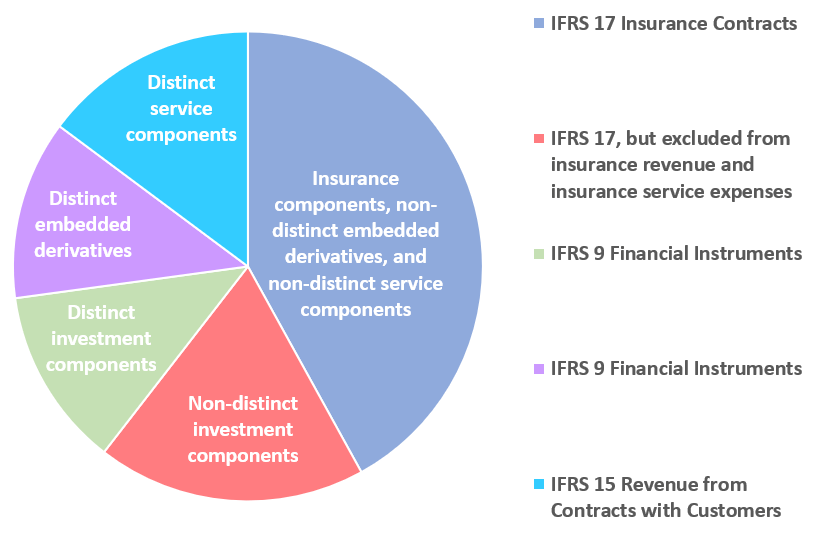

Separation of Contract Components

The following infographic illustrates the potential separation of contracts into the following components:

- Insurance Contracts – these are subject to IFRS 17

- Non-distinct Embedded Derivatives – these are subject to IFRS 17

- Non-distinct Service Components – these are subject to IFRS 17

- Non-distinct Investment Components – these are subject to IFRS 17, however, the results are excluded from insurance revenue and insurance service expenses

- Distinct Investment Components – these are subject to IFRS 9 and not IFRS 17

- Distinct Embedded Derivatives – these are subject to IFRS 9 and not IFRS 17

- Distinct Service Components – these are subject to IFRS 15 and not IFRS 17

IFRS 17 Portfolios

Portfolio: a collection of insurance contracts that are subject to similar risks and that are managed together

Subject to Similar Risk:

- Contracts within a product line have the same risks and contracts within different product lines have different risk

Managed Together:

- Allows for the possibility of contracts in different product lines to be allocated into common portfolios

Directly written business and ceded business (reinsurance contracts held) are required to be split into two portfolios. For one product that is reinsured, you would have one portfolio for the Gross or Directly written business and one portfolio for the reinsurance associated with the business.

IFRS 17 Groups

Further division of Portfolios into Groups of Insurance Contracts

3 Requirements for a Group:

- Profitability (3 types of groups)

- Annual Cohorts

- Further Considerations

1. Profitability (3 Types of Groups):

- Onerous at initial recognition (Onerous means ‘unprofitable’, initial recognition generally means when coverage for the group starts – some intricacies to consider)

- Have no Significant Possibility of Becoming Onerous (rare, but represents very profitable contracts)

- All Remaining Contracts (most insurance contracts will be in this type of group)

2. Annual Cohorts:

- Each group should contain only contracts issued within one year or less of another

3. Further Considerations:

- Geography, Product subtypes (T10 vs. T20), quarterly, monthly, etc.

- More applicable to large insurers

Measurement Models

- General Measurement Approach (GMA)

- Premium Allocation Approach (PAA)

- Variable Fee Approach (VFA)

General Measurement Model (GMM)

- Approach used for most long term contracts

- Also known as the “Building Block Approach”

- Has 3 components (or “Building Blocks”):

- Best Estimate Liability (BEL)

- Risk Adjustment (RA)

- Contractual Service Margin (CSM)

- The BEL and RA added together are also known as the Fulfilment Cash Flows

Premium Allocation Approach (PAA)

- Simplified approach for short-term insurance contracts (12 months or less)

- May also be used for contracts where PAA would not differ materially from GMA over the life of the product

- Applicable to many Group coverages and P&C coverages

Variable Fee Approach (VFA)

- Approach used to measure insurance contracts with direct participation features:

- Policyholder participates in a share of a clearly identified pool of underlying items

- Entity expects to pay the policyholder a substantial share of the fair value returns on underlying items

- Entity expects a substantial portion of any change in amounts to be paid to the policyholder to vary with the change in fair value of underlying items

- Same building blocks as the GMA but with special treatment of the CSM

Measurement Models for Typical Canadian Products

| Product | GMA | Eligible for PAA? | VFA required? |

| Group insurance with coverage period of one year or less | Yes | Yes | No |

| Group insurance with coverage period greater than one year | Yes | Maybe | No |

| Term life and whole life | Yes | No | No |

| Segregated funds | Possibly | No | Likely |

| Universal life | Maybe | No | Maybe |

| Participating life | Possibly | No | Likely |

| Critical illness, disability income, long-term care | Yes | No | No |

| P&C products with coverage period of one year or less | Yes | Yes | No |

| P&C products with coverage period greater than one year | Yes | Maybe | No |

Liability for Remaining Coverage (LRC)

IFRS 17 Appendix A Definition:

“An entity’s obligation to investigate and pay valid claims under existing insurance contracts for insured events that have not yet occurred (i.e. the obligation that relates to the unexpired portion of the coverage period).”

GMA (most Life contracts, some P&C/Group contracts):

- Best Estimate Liability

- Risk Adjustment

- Contractual Service Margin

PAA (most P&C contracts and Group Contracts):

- Unearned Premium Reserve (premiums received and not premiums written)

Liability for Incurred Claims (LIC)

IFRS 17 Appendix A Definition:

“An entity’s obligation to investigate and pay valid claims for insured events that have already occurred, including events that have occurred but for which claims have not been reported, and other incurred insurance expenses.”

Life and Group Insurance:

- Claims Payable

- Incurred but not Reported (IBNR) Reserves

- Disability Life Reserves (DLRs)

P&C Insurance

- Case Reserves

- IBNR = IBNER + IBNYR

- IBNER: Incurred but not Enough Reported

- IBNYR: Incurred but not Yet Reported