Discount Rates P&C Insurers

The methodology used to discount actuarial liabilities under IFRS 17 is a major change vs. the prior accounting standard. This course will dive into the potential approaches to discount fulfilment cash flows from the perspective of a P&C insurer.

IFRS 17 Discount Rates

IFRS Paragraph 36

“An entity shall adjust the estimates of future cash flows to reflect the time value of money and the financial risks related to those cash flows, to the extent that the financial risks are not included in the estimates of cash flows.”

“The discount rates applied to the estimates of the future cash flows shall:

- Reflect the time value of money, the characteristics of the cash flows and the liquidity characteristics of the insurance contracts;

- Be consistent with observable current market prices (if any) for financial instruments with cash flows whose characteristics are consistent with those of the Insurance Contracts, in terms of , for example, timing, currency and liquidity; and

- Exclude the effect of factors that influence such observable market prices but do not affect the future cash flows of the insurance contracts.”

Important Considerations

- There is no directly observable market data that exactly represents the characteristics and liquidity profile of an insurance contract

- Theoretical approaches to derive the illiquidity premium are required

Two Approaches in the Standard:

- Bottom-Up Approach

- Top-Down Approach

Bottom-Up Approach

Discount Rate = Risk Free Rate + Illiquidity Premium

Advantage:

- Risk-free yields are readily available

Disadvantage:

- Difficult to derive an illiquidity premium for insurance contracts

Risk Free Rates:

- Government of Canada bonds are considered to be risk-free

- Readily available source of risk-free rates

- Zero-coupon, spot and forward rates available

- Timeliness – updated daily/weekly

- Availability of data is granular – maturities ranging from 3 months to 30 years

Illiquidity Premium:

- Difficult to obtain – no reference assets available

- Theoretical Approach Required

- “Hybrid Approach”

- Utilize the Top-Down Approach to derive a suitable illiquidity premium, then add it to the risk-free curve

Top-Down Approach

Discount Rate = Reference Portfolio Rate

– Credit Risk Adjustments

– Market Risk Adjustments

– Other Risk Adjustments

Advantage:

- Does not require an explicit derivation of an illiquidity premium

Disadvantage:

- Difficult to determine an appropriate reference portfolio

- Complexity to determine appropriate adjustments for credit, market and other risks

Liquidity of P&C Insurance Contracts

Liquidity of Most Standard P&C Products

| LRC | LIC | |

| Liquidity Level | Liquid | Illiquid |

| Basis for Varying Liquidity | Ability of policyholder to cancel policy before expiry date and to receive value without significant exit costs. | Inability of the policyholder to obtain the exit value in advance of “normal” payment dates. |

Liquidity of Non-Standard P&C Products

| Liquidity | Reasoning | |

| Title Insurance | Illiquid | Lump-sum premium is earned at issuance. No cancellation options available that would result in any return of premium. |

| Mortgage | Illiquid | Lump-sum premium at the issuance of the mortgage. If mortgage is pre-paid or discharged, policyholder is not entitled to any premium refund. |

| Contract Surety | Illiquid | Policyholder cannot cancel the policy because the policyholder is not the beneficiary of the policy. The contract expires after the completion of the project (or after completion of all projects specified in the policy). |

| Fidelity and Fiduciary Surety | Liquid | In most cases, the policy is mandatory, but the policyholder may cancel the policy if the obligation ends or if the policyholder finds a more attractive policy. |

| Warranty | Liquid – if Cancellable Illiquid – if non-cancellable |

In most provinces, contracts are cancellable, and the policyholder would be entitled to a pro-rated refund. In some provinces, the contract might not be cancellable, in which case it would be considered illiquid. |

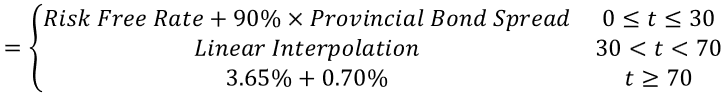

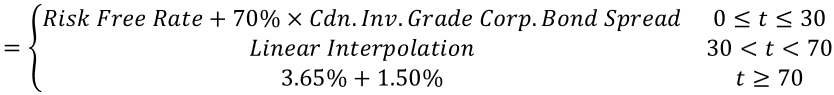

CIA Reference Curves

- CIA partnered with Fiera to publish the CIA reference curve monthly

- https://www.fieracapital.com/en/institutional-markets/cia-ifrs-17-curves

Liquid Curve

Illiquid Curve

Insurance Finance Expense

Two Main Components of Insurance Finance Expense:

- The “effect of the time value of money” – this refers to the unwinding of the discount rate and represents the release of the effect of discounting due to the passage of time.

- The “effect of changes in the time value of money” – this refers to the effect of changes in the discount rates from period to period

- “Effect of the time value of money”

- Expected interest earned/accreted on the BEL, RA and CSM

- “Effect of changes in the time value of money”

- Change in Liabilities (BEL and RA only) due to changes in the IFRS 17 discount rates during the period

Locked-In Yield Curves

Locked-In Yield Curve:

Yield curve determined either at the initial recognition of a group of contracts or at the date of incurred claims

Used for 3 Purposes:

- Adjusting and accreting interest on the CSM

- Systematic allocation of insurance finance income/expense to the income statement if the entity chooses to disaggregate the insurance finance income/expense between profit/loss and OCI

- Entity uses the PAA and there is a significant component

P&C Typical Uses:

P&C Insurance Contracts typically do not use locked-in curves, except for when:

- The entity uses the GMA to determine the Liability for Remaining Claims (LRC)

- The entity elects the OCI option for some portfolios of contracts