General Measurement Approach

The GMA or General Measurement Approach is the valuation approach used by most life insurers. It is also used by some P&C insurers that issue contracts that are longer than 1 year.

General Measurement Approach

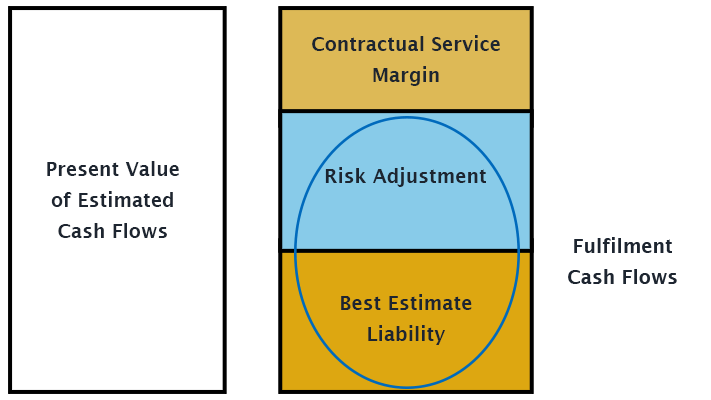

The General Measurement Approach or “GMA”, is also known as the Building Block Approach. This is because the Liabilty for Remaining Coverage (LRC) consists of 3 components or “building blocks” as shown below.

Note that the General Measurement Approach or “GMA” is also often referred to as the General Measurement Model or “GMM”. For purposes of our Training Series, we will use the GMA (we prefer the General Measurement Approach, as the other two approaches are the Premium Allocation Approach and the Variable Fee Approach. The GMA matches the PAA and VFA naming convention of using the word “approach”).

The components are as follows:

( + ) Best Estimate Liability

( + ) Risk Adjustment

( + ) Contractual Service Margin

The image below shows the components of the LRC. The first two components, the Best Estimate Liability and the Risk Adjustment are also known as the Fulfilment Cash Flows.

Fulfilment Cash Flows

An explicit, unbiased and probability-weighted estimate (i.e. expected value) of the present value of the future cash outflows minus the present value of the future cash inflows that will arise as the entity fulfils insurance contracts, including a risk adjustment for non-financial risk.

𝑭𝒖𝒍𝒇𝒊𝒍𝒎𝒆𝒏𝒕 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘𝒔 = 𝑷𝑽(𝑭𝒖𝒕𝒖𝒓𝒆 𝑶𝒖𝒕𝒇𝒍𝒐𝒘𝒔) − 𝑷𝑽(𝑭𝒖𝒕𝒖𝒓𝒆 𝑰𝒏𝒇𝒍𝒐𝒘𝒔) + 𝑹𝒊𝒔𝒌 𝑨𝒅𝒋𝒖𝒔𝒕𝒎𝒆𝒏𝒕

𝑭𝒖𝒍𝒇𝒊𝒍𝒎𝒆𝒏𝒕 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘𝒔 = 𝑩𝒆𝒔𝒕 𝑬𝒔𝒕𝒊𝒎𝒂𝒕𝒆 𝑳𝒊𝒂𝒃𝒊𝒍𝒊𝒕𝒚 + 𝑹𝒊𝒔𝒌 𝑨𝒅𝒋𝒖𝒔𝒕𝒎𝒆𝒏𝒕

Best Estimate Liability

- Unbiased and Probability-Weighted Estimate of Future Cash Flows

- Similar to what was done under IFRS 4/CALM

- Project out the Cash Flows for Insurance Products Using Actuarial Techniques

- Key Differences vs. IFRS 4:

- Contract Boundary

- Cash Flows that are Included

- No Implicit Margins Allowed

- Discounting Approach

Contract Boundary Wording

A substantive obligation to provide services ends when:

- The entity has the practical ability to reassess the risks of a particular policyholder and, as a result, can set a price or level of benefits that fully reflects those risks; or

- Both of the following are satisfied:

- The entity has the practical ability to reassess the risks of the portfolio of insurance contracts that contains the contract and, as a result, can set a price or level of benefits that fully reflects the risk of that portfolio.

- The pricing of premiums for coverage up to the date when the risks are reassessed does not take into account the risks that relate to periods after the reassessment date.

Best Estimate Liability

Cash Flows Included in Fulfilment Cash Flows

- (+) Premiums

- (-) Claims (claim payables, IBNR, future claims)

- (+) Salvage and Subrogation (P&C contracts)

- (-) Transaction based taxes (premium tax, fire tax, RST, HST, GST, etc.)

- (-) Insurance Acquisition Costs

- (-) Claim Handling Costs

- (-) Policy Administration and Maintenance Costs

- (-) Allocation of Fixed and Variable Overheads Directly Attributable

- (-) Payments to policyholder resulting from options/guarantees that are not separated from the insurance contract

Cash Flows Not Included in Fulfilment Cash Flows

- Investment Returns

- Cash Flows Related to Reinsurance Contracts Held (these are presented separately under IFRS 17)

- Cash Flows related to Future Insurance Contracts

- Cash Flows relating to costs that are non-attributable (certain product development costs, training costs – expensed as incurred)

- Cash Flows from Abnormal Amounts of Wasted Labour or Other Resources

- Income Tax Payments and Receipts that the Insurer does not pay or receive in a fiduciary duty

- Cash Flows arising from Components separated from the insurance contract and accounted for under other accounting standards

Risk Adjustment (Non-Financial Risk)

- Similar to the current Provisions for Adverse Deviations (PfADs) – but only Non-Financial Risks

- Need to specify a Confidence Level and Approach Used

- Need to consider Diversification Benefits

- Represent the Entity’s Required Compensation for Taking on the Risk, not the Appointed Actuary’s view of the Risk

- Risk Adjustment is the level of compensation that the entity would require to make it indifferent between:

- Fulfilling an insurance contract liability that has a fixed cash flow, such as $100

- Fulfilling an insurance contract liability that has a range of possible outcomes, such as 50% $0 and 50% $200 (E(value) = 50% x 0 + 50% x 200 = $100)

5 Characteristics of a Risk Adjustment

- Risks with low frequency, high severity, will result in higher RAs, than risks with high frequency, low severity

- For similar risks, contracts with a longer duration will result in a higher RA than contracts with a shorter duration

- Risks with a wider distribution of losses, will result in higher RAs than risks with a narrower distribution of losses

- The less that is known about the current estimate and its trend, the higher the RA

- To the extent that emerging experience reduces uncertainty about the amount and timing of cash flows, RA will decrease and vice versa

Measurement Methods for the Risk Adjustment

- IFRS 17 does not prescribe a method to quantify the RA

- Potential Measurement Methods Include:

- Cost of Capital Method

- Quantile Techniques (Simulation -> Value-at-Risk, CTE)

- Margins on Assumptions

Contractual Service Margin (new)

- Represents the Unearned Profit for a Group of Insurance Contracts

- At Issue, equal to the Present Value of Future Profits of the Group of Insurance Contracts

- Amortize the Profit over the life of the contracts

- Eliminates the notion of “Negative Reserves”

- Discount rate is locked-in at issue

- Need to store the CSM and Interest Rate Vector for each group at each reporting date

Contractual Service Margin Definition

IFRS 17 Appendix A Definition:

“A component of the carrying amount of the asset or liability for a group of insurance contracts representing the unearned profit the entity will recognize as it provides services under the insurance contracts in the group”

CSM will be established when, on initial recognition of a group of insurance contracts, the sum of the following results in an expected net cash inflow:

- The fulfilment cash flows;

- The derecognition of any asset or liability recognized for insurance acquisition cash flows prior to initial recognition; and

- Any cash flows arising from the group on the date of initial recognition

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

Contractual Service Margin

CSM or Loss Component at Initial Recognition:

Outcome 1:

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

Outcome 2:

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component

Contractual Service Margin (Example)

CSM at Initial Recognition:

Scenario 1:

PV(Outflows) = 80; PV(Inflows) = 100; RA = 10

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

80 – 100 + 10 = -10, since this is negative, CSM = 10

Scenario 2:

PV(Outflows) = 95; PV(Inflows) = 100; RA = 10

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component (LC)

95 – 100 + 10 = 5, since this is positive, Loss Component = 5

Onerous Contracts

IFRS 17 Paragraph 47

“An insurance contract is onerous at the date of initial recognition if the fulfilment cash flows allocated to the contract, any previously recognized acquisition cash flows and any cash flows arising from the contract at the date of initial recognition in total are a net outflow.”

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component (LC)

A Group of Contracts can subsequently become onerous if the CSM balance goes negative, creating a Loss Component.

Contractual Service Margin Roll Forward

Opening CSM

- ( + ) CSM for New Contracts Added to the Group

- ( + ) Interest Accreted on the CSM

- (+/-) Changes in Fulfilment Cash Flows Relating to Future Service

- (+/-) Effects of Currency Exchange Differences on the CSM

- ( – ) Amount of CSM Recognized into Profit or Loss

Closing CSM

| CSM Beginning of Period: | 1,000,000 |

| (+) CSM from New Business | 600,000 |

| (+) Interest Accretion on CSM | 48,000 |

| (-) Expected Premiums | (250,000) |

| (+) Actual Premiums | 252,500 |

| (+) Expected Premium Tax | 6,250 |

| (-) Actual Premium Tax | (6,300) |

| (+) Expected Acquisition Expenses | 65,000 |

| (-) Actual Acquisition Expenses | (60,000) |

| (+) Expected Investment Components | 30,000 |

| (-) Actual Investment Components | (25,000) |

| (+/-) Experience Adjustments / Assumption Changes on BEL + RA | (160,000) |

| (+/-) Currency Exchange Differences on CSM | 0 |

| (-) CSM Amortized into P&L | (149,000) |

| CSM End of Period: | 1,346,450 |