Onerous Contracts & Loss Components

IFRS 17 introduces the concepts of a loss component and onerous contracts. This course will teach you the basics and give you the foundational undestanding you need.

Contractual Service Margin Definition

IFRS 17 Appendix A Definition:

“A component of the carrying amount of the asset or liability for a group of insurance contracts representing the unearned profit the entity will recognize as it provides services under the insurance contracts in the group”

CSM will be established when, on initial recognition of a group of insurance contracts, the sum of the following results in an expected net cash inflow:

- The fulfilment cash flows;

- The derecognition of any asset or liability recognized for insurance acquisition cash flows prior to initial recognition; and

- Any cash flows arising from the group on the date of initial recognition

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

Contractual Service Margin

CSM or Loss Component at Initial Recognition:

Outcome 1:

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

Outcome 2:

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component

Contractual Service Margin (Example)

CSM at Initial Recognition:

Scenario 1:

PV(Outflows) = 80; PV(Inflows) = 100; RA = 10

PV(Outflows) – PV(Inflows) + Risk Adjustment < 0 -> CSM

80 – 100 + 10 = -10, since this is negative, CSM = 10

Scenario 2:

PV(Outflows) = 95; PV(Inflows) = 100; RA = 10

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component (LC)

95 – 100 + 10 = 5, since this is positive, Loss Component = 5

Onerous Contracts

Onerous Contracts occur when, on initial recognition of a group of insurance contracts, the sum of the following results in an expected net cash outflow:

- The fulfilment cash flows;

- The derecognition of any asset or liability recognized for insurance acquisition cash flows prior to initial recognition; and

- Any cash flows arising from the group on the date of initial recognition

PV(Outflows) – PV(Inflows) + Risk Adjustment > 0 -> Loss Component (LC)

- A Group of Insurance contracts can become onerous (or more onerous) after initial recognition as well.

- This would occur if the CSM Balance goes negative in a period (or the Loss Component goes more negative)

- This could occur from:

- Unfavorable changes to the fulfilment cash flows, due to changes in the BEL or RA

- Unfavorable experience emerges, unfavorable assumption changes on the BEL or RA

Loss Components

- Entity shall establish (or increase) a Loss Component of the Liability for Remaining Coverage for an Onerous Group

- Loss Component determines the amounts that are presented in profit or loss as reversals of losses on onerous groups and are consequently excluded from the determination of insurance revenue

- Loss Components are recognized immediately in the income statement and are not deferred like the CSM

- Loss Component can be established at Inception of a Group of Contracts or Subsequently if a Group that had Positive CSM, flips to a Negative Balance (due to adverse experience that emerges)

- Loss Components can also flip back to a CSM if favorable experience emerges

- Loss Components must be tracked and rolled forward each period, much like CSM balances are tracked and rolled forward each period

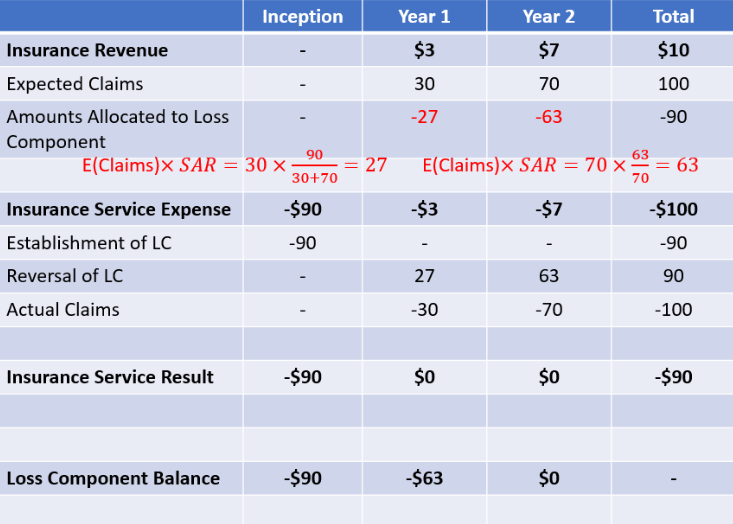

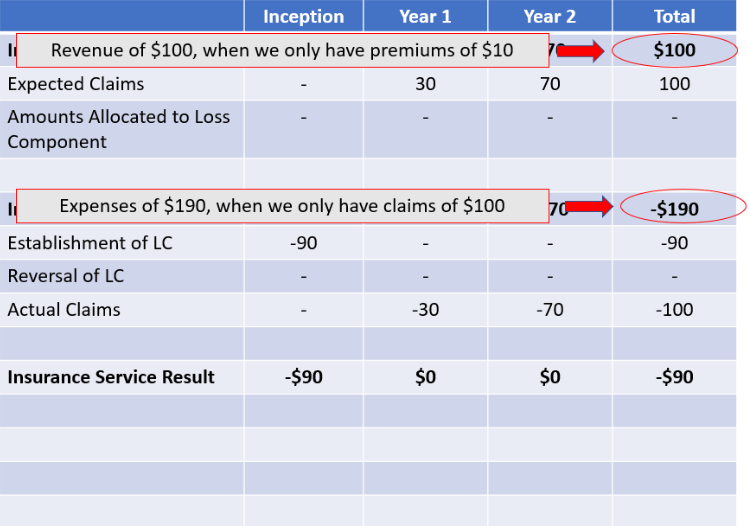

Loss Components Example

Example:

Suppose that you have a 2-year product with premiums of $5 each year. The actual claims that occur in year 1 are $30 and in year 2 are $70. This is known at issue and a Loss Component is setup. We will ignore discounting and risk adjustments.

Loss Component = PV(Outflows) – PV(Inflows) + RA

Loss Component = (30 + 70) – (5 + 5) = 90

- First we will show the Insurance Service Result with no systematic allocation of the loss component

- Now let us construct the Statement of Financial Performance (“Income Statement”) for this example.

- The formula to “systematically allocate” the Loss Component will be:

𝑆𝑦𝑠𝑡𝑒𝑚𝑎𝑡𝑖𝑐 𝐴𝑙𝑙𝑜𝑐𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑖𝑜= (𝐿𝑜𝑠𝑠 𝐶𝑜𝑚𝑝𝑜𝑛𝑒𝑛𝑡 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑜𝑓 𝑃𝑒𝑟𝑖𝑜𝑑) / (𝑃𝑉(𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐶𝑙𝑎𝑖𝑚𝑠 & 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠))