Premium Allocation Approach

Dive into the world of PAA – Premium Allocation Approach training. The PAA is used by most P&C insurers and Group insurers. PAA automatically applies for contracts that are 12 months or less in duration.

Premium Allocation Approach

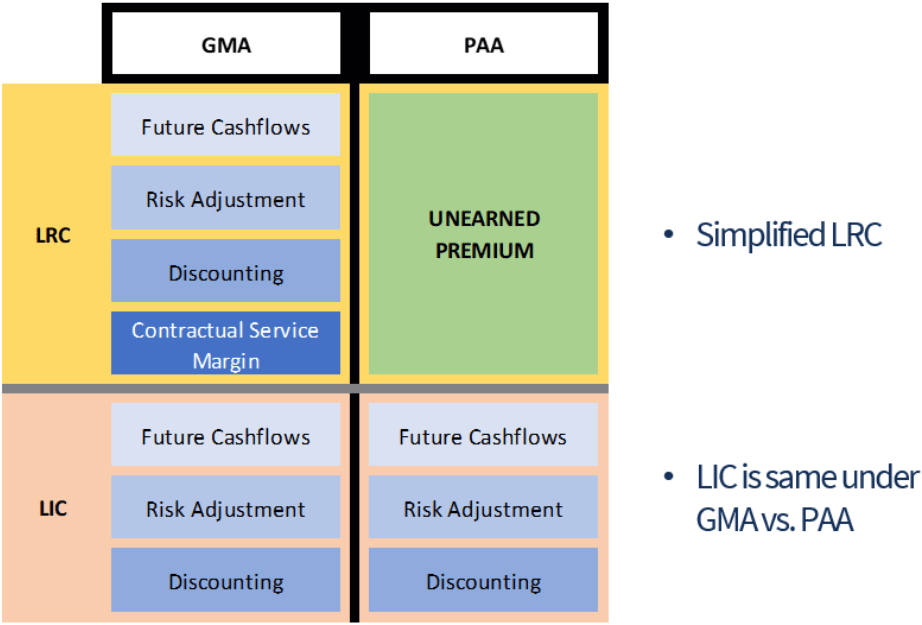

- Measurement model to calculate the Liability for Remaining Coverage (LRC)

- Simplified Approach compared to the GMA

- Applicable to many Group and Property and Casualty (P&C) contracts

Eligibility For the PAA

- A group of insurance contracts is eligible to use the PAA if:

- The coverage period of each contract in the group is one year or less ; OR

- The LRC calculated under the PAA is not materially different from the LRC calculated under the GMA

- Entity has a choice to adopt the PAA if eligible, but it is not required. With that being said, most entities would choose to adopt the PAA as it is much simpler than the GMA.

Liability Overview

Liability For Remaining Coverage (LRC)

- Unearned Premium Approach similar to IFRS 4, the difference is in the definition of the premium.

- Under IFRS 4, the unearned premiums were based on Premiums Written, but under IFRS 17, the unearned premiums are based on Premiums Received

- LRC on initial Recognition:

- ( + ) Premiums Received at Initial Recognition

- ( – ) Acquisition Cashflows at Initial Recognition (if any)

- ( +/- ) DAC asset/liability derecognition (if any)

Insurance Acquisition Cashflows

- Acquisition cashflows under the GMA are deferred. PAA also uses this approach by default, however:

- Entity can elect to expense acquisition cashflows as incurred if the coverage period is 1 year or less

Discounting

- LRC under the PAA is not always adjusted for discounting

- Discounting is not required, when coverage is provided less than 1 year from when premium is received

- Discounting is required, when coverage is provided more than 1 year from when premium is received AND the contracts have a significant financing component

- IFRS 15: Revenue Recognition

- If applicable, PAA discounting methodology is the same as GMA

Risk Adjustment

- Risk Adjustment is not required for the LRC under PAA unless the group of contracts is onerous.

- Risk Adjustment is required for the LIC under the PAA

Revenue Recognition

- PAA Insurance Revenue: Expected premium receipts allocated to the period, excluding investment components.

- Allocation is either:

- Uniform (straight-line passage of time); OR

- Follows insurance service expense patterns (claim patterns) if significantly different from uniform (seasonal claims, etc.)

Investment Component

- Investment Component: any amount that is eligible to be paid whether an insured event occurs or not

- Cash surrender values and endowments are examples of investment components for longer-term contracts

- Investment component experience is reported separately

Onerous Contracts

- When a group of contracts becomes onerous, a loss is recognized immediately

- Framework required to identify when a group of PAA contracts becomes onerous

- Potential things to examine:

- Loss ratios of a group of contracts

- When expected costs increase

- When there are regulatory or economic changes